States with established medical and recreational legal cannabis markets impose a tax on the sale of marijuana. However, unlike the “sin tax” (imposed on the likes of cigarettes) meant to discourage overconsumption, the collected pot taxes are aimed at funding government-led programs.

One of the keys to staying compliant as a dispensary is understanding state-imposed tax and how it can affect your business. If you’re in the process of putting up your dream cannabis business, it’s important you know how much your state levy on cannabis tax.

In this blog, we will explore how much dispensaries pay in weed taxes by state, breaking down the complex fiscal numbers into easily digestible information.

Understanding Dispensary Tax Obligations

Dispensaries, like any business, are subject to various taxes. However, due to the nature of their products, they often face additional tax burdens. Here’s a simple breakdown of what these taxes typically include.

The primary taxes that dispensaries encounter are federal, state, and local taxes. On the federal level, dispensaries have to comply with IRS Code Section 280E, which disallows many standard business deductions.

State taxes on weed vary greatly, with some states imposing local excise taxes, weight-based or potency-based taxes. Local taxes might include additional excise taxes or licensing fees.

This multilayered taxation system makes running a dispensary particularly challenging.

Federal Weed Tax Implications

At the federal level, dispensaries primarily deal with the IRS code Section 280E, which disallows standard business deductions for expenses connected to the trafficking of controlled substances, severely impacting profitability.

Section 280E has significant financial implications for dispensaries. This regulation, stemming from the Controlled Substances Act, means that dispensaries cannot deduct common business expenses like rent, salaries, or utilities from their taxable income.

The only deductions allowed are for the cost of goods sold (COGS), which directly impacts the cost of the cannabis product itself. This creates a heavy tax burden, often resulting in higher tax rates than other businesses.

State-Specific Tax Rates

State taxes on dispensaries vary widely. Some states impose excise taxes, while others have gross receipts taxes, significantly affecting the bottom line. Let’s take a closer look at some examples.

In California, for instance, dispensaries face a 15% excise tax on cannabis sales. Additionally, local municipalities can impose taxes, increasing the total tax rate.

Contrast this with Oregon, where the state imposes a 17% excise tax on cannabis sales, plus up to 3% additional local taxes totaling 20%. This variability makes it crucial for dispensary owners to understand their state tax obligations.

Some states implement weight-based taxes, where different parts of the plant are taxed at different rates. For instance, Alaska charges $50 per ounce of flower and $15 per ounce of trim. These taxes are collected on the first sale from the cultivator. Nevada, similarly, levies a tax based on the product’s fair market value at wholesale.

| 📕Must-Read Navigate Taxation and Accounting as a cannabinoid business through this guide. |

How Much Do Dispensaries Pay in Taxes in All 50 States?

The table below shows the cannabis-related excise, sales, and cultivation tax rate per state as of 2024. Most of the states noted as “N/A” are states that have yet to legalize recreational and medical cannabis.

| State | Excise Tax | Sales Tax | Cultivation Tax |

| Alabama (AL) | 9% of the gross proceeds of the medical cannabis sales | N/A | N/A |

| Alaska (AK) | $50 per ounce for mature flowers or buds $15 per ounce for trim $25 per ounce for immature flowers or buds $1 per clone | N/A | N/A |

| Arizona (AZ) | 16% | N/A | N/A |

| Arkansas (AR) | 4% special privilege tax | N/A | N/A |

| California (CA) | 15% | 7.25% | $9.25/ounce for flowers $2.75/ounce for leaves $1.29/ounce for fresh plant materials |

| Colorado (CO) | 15% | 2.9% | N/A |

| Connecticut (CT) | 2.75 cents for a milligram of THC-infused edibles 0.9 cents for a milligram of THC for other cannabis infused products | 3% | N/A |

| Delaware (DE) | 15% | N/A | N/A |

| Florida (FL) | N/A | 6% | N/A |

| Georgia (GA) | N/A | N/A | N/A |

| Hawaii (HI) | 15% | N/A | N/A |

| Idaho (ID) | N/A | N/A | N/A |

| Illinois (IL) | 10% for an item with less than 35% THC 25% for above 35% THC products | 20% tax for cannabis edibles | 7% excise tax on the cultivator’s gross receipts |

| Indiana (IN) | N/A | N/A | N/A |

| Iowa (IA) | 6% | N/A | N/A |

| Kansas (KS) | N/A | N/A | N/A |

| Kentucky (KY) | N/A | N/A | N/A |

| Louisiana (LA) | 4.45% | N/A | N/A |

| Maine (ME) | Excise tax of $335 per pound – flower Excise tax of $94 per pound – trim Excise tax of $1.50 per seedling Excise tax of $0.35 per seed | 10% | N/A |

| Maryland (MD) | 9% | N/A | N/A |

| Massachusetts (MA) | 10.75% | 6.25% | N/A |

| Michigan (MI) | 10% | 6% | N/A |

| Minnesota (MN) | 10% | 6.87% | N/A |

| Mississippi (MS) | N/A | 7% | N/A |

| Missouri (MO) | 6% for recreational marijuana 4% for medical cannabis | 16% | N/A |

| Montana (MT) | 20% for recreational cannabis 4% for medical cannabis | Local sales tax can reach up to 3% | N/A |

| Nebraska (NE) | N/A | N/A | N/A |

| Nevada (NV) | 15% | 6.85% | N/A |

| New Hampshire (NH) | N/A | 9% | N/A |

| New Jersey (NJ) | N/A | 2% | $1.24 per ounce |

| New Mexico (NM) | 12% | N/A | N/A |

| New York (NY) | 13% | N/A | N/A |

| North Carolina (NC) | N/A | N/A | N/A |

| North Dakota (ND) | N/A | 5% | N/A |

| Ohio (OH) | 10% | N/A | N/A |

| Oklahoma (OK) | 7% | N/A | N/A |

| Oregon (OR) | 17% | 3% local options sales tax | N/A |

| Pennsylvania (PA) | N/A | 6% | N/A |

| Rhode Island (RI) | 10% 3% Local Excise Tax | 7% | N/A |

| South Carolina (SC) | N/A | N/A | N/A |

| South Dakota (SD) | N/A | 4.2% on medical cannabis | N/A |

| Tennessee (TN) | N/A | N/A | N/A |

| Texas (TX) | N/A | N/A | N/A |

| Utah (UT) | 4% on medical cannabis products | 4.85% | N/A |

| Vermont (VT) | 14% | 6% | N/A |

| Virginia (VA) | 21% | 3% local options sales tax | N/A |

| Washington (WA) | 37% | N/A | N/A |

| West Virginia (WV) | 10% over medical cannabis | N/A | N/A |

| Wisconsin (WI) | N/A | N/A | N/A |

| Wyoming (WY) | N/A | N/A | N/A |

Hidden Costs and Additional Fees

Beyond the obvious taxes, dispensaries must also consider other costs like licensing fees, local taxes, and compliance fees. These hidden costs add up and need to be factored into the financial planning.

Licensing fees can be particularly burdensome. For example, in California, annual licensing fees for dispensaries can range from $4,000 to $120,000, depending on the estimated gross revenue of the business.

Additionally, local jurisdictions often impose their own fees, adding further to the financial load. The need for compliance with both state and local regulations frequently necessitates hiring specialized legal and accounting professionals, which further escalates operational costs.

Local municipalities might also set compliance fees related to health and safety ordinances. For instance, dispensaries might be required to implement costly security measures, such as high-tech surveillance systems and secure storage facilities. These expenses, while not direct taxes, are necessary for maintaining a compliant and licensed operation.

This complex web of financial obligations highlights the need for meticulous financial planning.

| 📕 Must-Read Get a rough estimate on the cost of establishing a dispensary per state. From licensing to marketing and advertising, this blog breaks down the cost of putting up and maintaining a dispensary. |

Dispensary Tax Calculator: How to Calculate Cannabis Taxes?

Are you curious about how dispensary storeowners calculate their final retail price? It’s a simple weed tax calculator math process that includes getting the excise and sales taxes and adding them to the total purchasing amount.

Here’s how it goes.

Step 1: Know the simple formulas used in calculating cannabis taxes for excise tax, sales tax, and the total tax amount:

1. Excise Tax Amount = Total Sale Amount x Excise Tax Rate

2. Sales Tax Amount = Total Sale Amount x Sales Tax Rate

3. Total Tax Amount = Excise Tax Amount + Sales Tax Amount

Step 2: Do the math!

Let’s use California’s cannabis tax rate to demonstrate how to calculate cannabis tax amounts. Currently, the state puts a 15% excise tax and 7.25% sales tax on cannabis products.

Let’s say a California-based dispensary decides to charge $100 for a certain cannabis product. Using the formulas presented above, the storeowner will arrive at the final cannabis purchase price.

Excise Tax Amount = Total Sale Amount x Excise Tax Rate

$15 = 100 x 0.15

Sales Tax Amount = Total Sale Amount x Sales Tax Rate

$7.25 = 100 x 0.0725

Total Tax Amount = Excise Tax Amount + Sales Tax Amount

$22.25 = 15 + 7.25

Step 3: Implement the results to your final cannabis retail pricing.

Final Cannabis Purchase Price = Total Sale Amount + Total Taxes

$122.25 = 100 + 22.25

Based on the calculations above, the final cannabis purchase price for a $100-worth cannabis product in California should be $122.25.

How Do Dispensaries Pay Federal Taxes and State Taxes?

At the federal level, the Internal Revenue Service (IRS) does not deduct for businesses selling controlled substances like marijuana (this applies to all dispensaries selling products with more than the allowed THC level).

This is part of the IRS code to discourage marijuana retailers from operating illegally in states without a legal cannabis provision. Still, like any other business in the US, dispensaries need to file a federal income tax return and pay the income tax (without deducting it from their operating expenses).

The only allowable deduction for marijuana dispensaries is the Cost of Goods Sold (COGS). This refers to inbound shipping and what store owners pay for their products.

At the state level, dispensaries pay state cannabis taxes through a structured process. This process varies by state but ultimately involves the following steps:

Step 1: Tax Registration

You must obtain a sales tax permit along with your business license. This is done by registering with your state’s tax authority, which allows for the legal collection and remittance of cannabis taxes.

Step 2: Tax Record Keeping

Maintain accurate and up-to-date records of cannabis sales and the amount of tax collected. This is important for the next step: tax reporting and remittance. Also, this will be the book checked during audits.

Step 3: Submit Tax Reports and Remittance

Dispensaries are asked to remit the collected tax revenue to the state and the tax record-keeping reports. Depending on the state, this could regularly occur monthly, quarterly, or annually. Cannabis business owners file tax returns that detail their sales and the taxes collected.

How Much Money Do States Make From Cannabis Taxes?

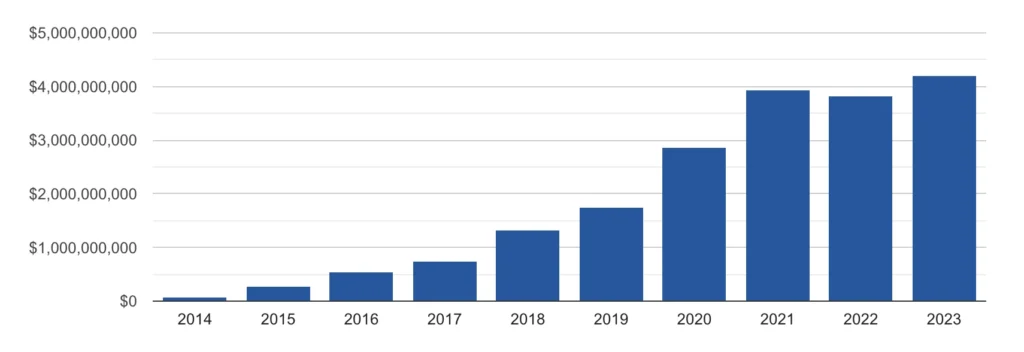

In the first quarter of 2024, the collective cannabis tax revenue from all states totaled $20 billion, and that’s from adult-use cannabis sales only. States that have legalized cannabis in their jurisdictions have been earning the fruit of their labor. Since 2014, the cannabis industry has proven to be a profitable state revenue channel, boosting budgets for important public services and programs.

This graph illustrates the increased total cannabis tax collection from all states since 2014.

Let’s look at how much marijuana tax by state revenue was collected from 2014 to 2024.

| State | State Tax Revenue from Adult-Use Cannabis |

| Colorado | $2,441,045,232 |

| Washington | $4,103,907,340 |

| Oregon | $1,017,962,248 |

| Alaska | $160,893,891 |

| Nevada | $1,104,810,050 |

| California | $5,706,335,788 |

| Massachusetts | $989,231,664 |

| Michigan | $1,217,838,513 |

| Illinois | $1,979,809,528 |

| Maine | $80,863,520 |

| Arizona | $702,781,901 |

| Montana | $106,507,918 |

| New Mexico | $122,892,108 |

| New Jersey | $65,921,737 |

| Vermont | $24,014,286 |

| Rhode Island | $15,687,184 |

| New York | approximately $21,000,000 |

| Connecticut | $29,518,377 |

| Missouri | $136,800,275 |

| Maryland | $40,230,000 |

| Ohio | $20,068,051,561 |

What Happens to The Marijuana Tax Revenue?

Most states allocate a portion of the cannabis tax revenue to specific programs. How the cannabis taxes are allocated depends on each state’s unique spending decisions. For example, states with a ballot system would most likely draft language about cannabis tax funding programs in the ballot measures that have proposed the legalization of cannabis.

Other states spend the cannabis tax revenue on the most obvious choices, such as funding community colleges, public school constructions, road repair, or healthcare programs.

At the moment, there is an increasing trend among states to use the cannabis tax collected to help the victims of past enforcement of drug laws. States like New Jersey, Massachusetts, Illinois, and New York dedicate a budget from a portion of their cannabis tax to support communities disproportionally affected by the previous war on drugs.

Some states chose to grant a percentage of the cannabis tax revenue to fund programs aimed at addressing substance abuse and drug education.

Strategies for Managing Tax Burden

There are ways dispensaries can manage their tax burden, from strategic financial planning to seeking professional advice. Here are some tips to help navigate the tax landscape more effectively.

One effective strategy is to meticulously track all expenses that qualify as the cost of goods sold (COGS), as these are the only expense deductions allowed under IRS Code Section 280E. Maintaining accurate and detailed records is critical for maximally reducing taxable income.

Another tactic involves exploring opportunities for local tax credits or incentives that might be available to businesses contributing to community development or environmental sustainability.

Consulting with a tax professional who specializes in the cannabis business can also provide significant advantages. They can offer insight into minimizing tax liability, structuring transactions to optimize tax outcomes, and ensuring compliance with state and local tax laws.

Additionally, being proactive about understanding upcoming changes in tax laws can help dispensaries plan strategically and adapt their business model accordingly.

Final Thoughts

Dispensaries face a unique and varied tax landscape across different states. Understanding these tax obligations is crucial for running a compliant and profitable business. While it can seem complicated, staying informed and consulting with a tax professional can make a significant difference.

Additionally, partnering with reputable cannabis brands such as The Hemp Doctor Wholesale, which is dedicated to producing a range of high-quality products while remaining compliant with state regulations, can help you focus on the financial aspects of your dispensary’s operations.

| Disclaimer: We strive to always provide factual and updated information in our blogs, but the information provided here shouldn’t be construed as legal advice. Always consult with a qualified legal or tax professional for advice specific to your situation. |

FAQs

How much do dispensaries pay in taxes in California?

The total cannabis tax in California-based dispensaries varies by location, but the statewide sales tax rate is 7.25%. This rate combines the 6% state tax and 1.25% mandatory local tax.

What is the tax on dispensaries in Illinois?

Cannabis cultivators are required to subject their products to a 7% tax. At the retail level, Illinois’ tax rate for cannabis products with less than 35% THC is 10% and 25% for those with above 35% THC.

How much is dispensary tax in Michigan?

Michigan levies a 10% excise tax on cannabis sales and 6% on sales tax.

What is excise tax on weed?

An excise tax on weed is a legislated tax on cannabis at the time they’re purchased.

What is the illinois marijuanas tax rate?

Illinois has an excise tax rate of 10% for cannabis items with less than 35% THC and 25% for products with more than 35% THC.