The green rush is real, and it’s already happening in Tennessee’s $200 million hemp industry. The fact remains: entering the dispensary business can be profitable.

However, launching a dispensary is not for the faint-hearted. It’s a business wrapped in compliance with state laws and upfront cash. If you’re willing to do the hard work, you can be part of the massive $30 billion cannabis market by 2025.

The legal side of how to open a hemp dispensary in Tennessee is shrouded in mystery. To help future dispensary owners, this blog uncovers the legal things to consider when putting up a cannabis establishment in Tennessee.

The Tennessee Cannabis Legal Landscape

Tennessee remains one of the few states to have a firm stance on cannabis. Possession of a half ounce of marijuana can lead to serious legal consequences. Furthermore, there are limited qualifying medical conditions under which it’s legal to acquire THC.

The state’s stern reputation on weed motivates those interested in entering the business to understand its cannabis regulation intricacies. Despite the learning curve, it’s possible to operate a fully compliant dispensary in Tennessee.

To start, it’s important to differentiate the terms—cannabis, hemp, and marijuana.

Hemp and marijuana belong to the same species: the cannabis sativa plant. Marijuana is cultivated for its psychoactive properties, while hemp is grown as a source of fiber.

According to the Tennessee Bureau of Investigation, the state has legalized the cultivation of hemp, which has less than 0.3% Delta-9 THC. Any cannabis sativa with more than 0.3% THC is considered a marijuana plant and is therefore illegal.

In 2017, the Tennessee legislature enacted HB 1164. The bill requires hemp growers to apply for a license with the Department of Agriculture. So far, you don’t need a license to process or sell hemp, except when the product is in the “food” category.

| 📝 Note Delta-9 tetrahydrocannabinol, simply called THC, is the main psychoactive component of the cannabis plant. In a significant amount (15% on average), Delta 9 can cause intoxication often associated with marijuana use. To date, Delta 9 is still included among the controlled substances in the US. |

While marijuana is prohibited in Tennessee, hemp-derived products like CBD (cannabidiol), CBN (cannabidiol), Delta 8 THC, and other cannabinoids can be sold legally. The circulation of these products is made possible by their less than 0.3% THC content.

Legal Things to Consider in Opening a Dispensary in Tennessee

After plotting your business plan, location, and financing, it’s now time to learn the legal facets of opening a dispensary in Tennessee:

1. Establishing a Business Entity

The process of registering your corporate entity and business name is under the Tennessee Secretary of State’s Office. Here’s how the process goes:

Step 1: Choose your legal business’s structure. It can be any of the following:

| Business Structure | Definition |

| Sole Proprietorship | The most basic form of business organization that treats the owner and the business as one entity. |

| General Partnership | Multiple individuals jointly own the business. Profits and losses of the business are shared by the group. |

| Limited Partnership (LP) | LP is formed by one or more general partners. You must submit a “Certificate of Limited Partnership” to the Tennessee Secretary of State. |

| Limited Liability Company (LLC) | As a versatile business entity, you must submit “Articles of Organization Limited Liability Company” to the Tennessee Secretary of State. |

| Corporation | Setting up a corporation requires submitting the “Articles of Incorporation For-Profit Corporation” or the “Articles of Incorporation Nonprofit Corporation.” |

Step 2: Select your business name

You can register the business name as a legal entity or as a trademark. The particular requirements for each route may change according to the nature of your business.

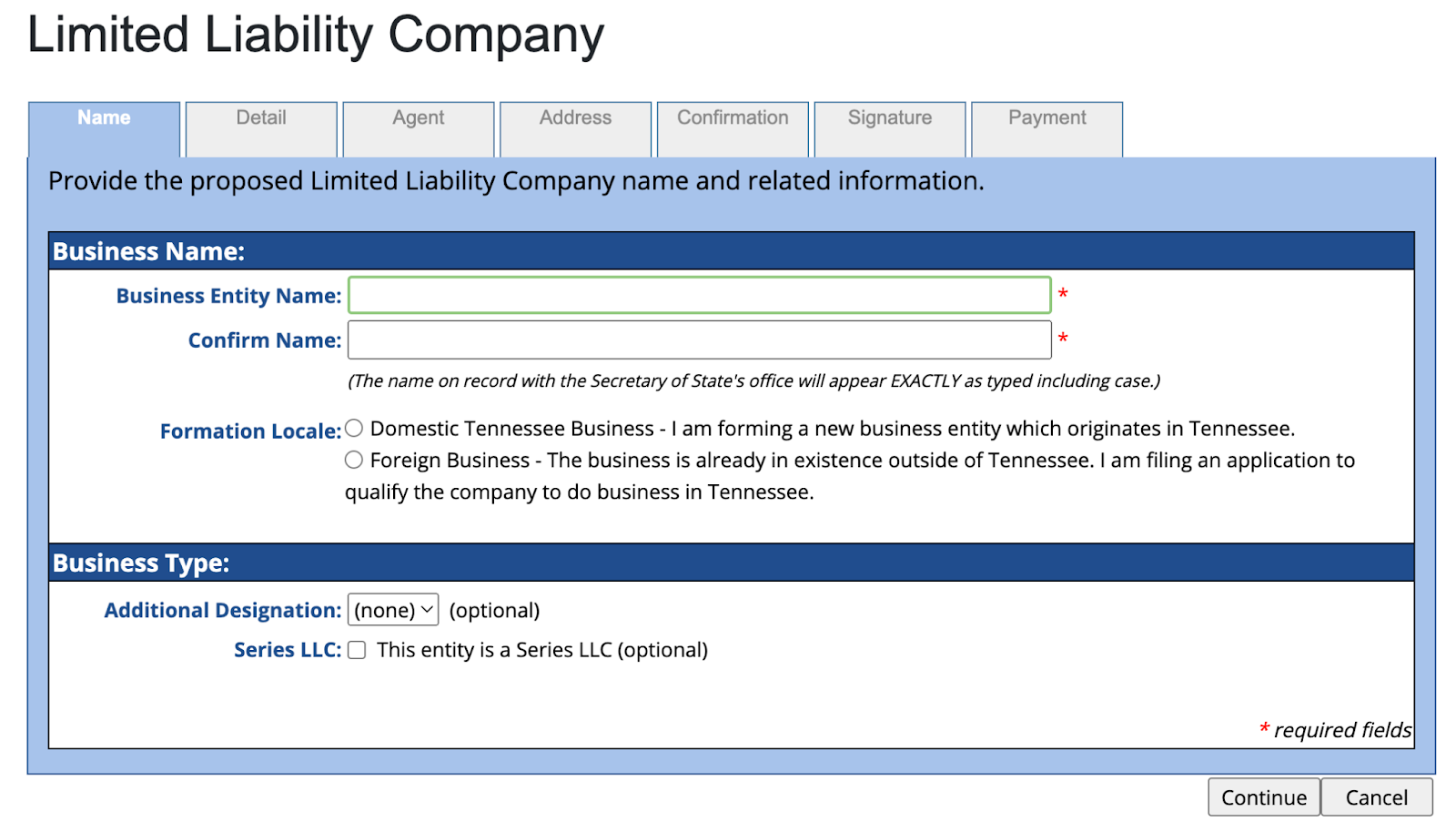

Step 3: Register using the Secretary of State’s online business registration system

Click this link to start. Here’s a sample page for an LLC type of business.

The Secretary of State’s online tool is only available for the following entity types:

- Limited Liability Company

- For-profit Corporation

- Nonprofit Corporation

- Limited Liability Company

- Limited Partnership

- General Partnership

If none of the entities mentioned is your business’s legal structure, use this form instead.

| ✅ Pro Tip You can employ third-party business registration service providers like ZenBusiness, Swyft Filings, Tailor Brands, and more for your business registration needs. These companies offer comprehensive assistance for ensuring state and federal business registration compliance. |

2. Obtaining the Licenses for Operating a Dispensary

Currently, Tennessee has no state-wide regulated dispensary system. Hence, the state does not issue licenses for those who want to sell hemp products within its jurisdiction.

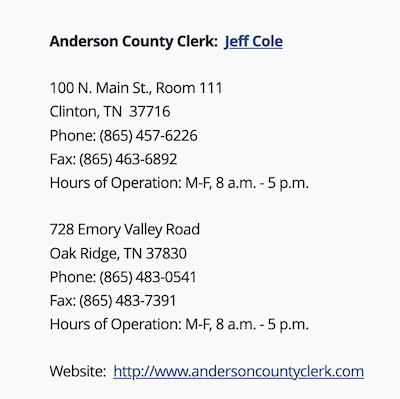

Like any business operating in Tennessee, dispensaries still need to process a business license. They are obtained through the city and county clerk where the dispensary is located.

Find your county’s contact person and address through this link. Clicking on your county will present an information like this:

Licenses vary according to a dispensary’s gross sales thresholds:

| Type of Business License | Gross Sales Thresholds |

| No business license | Under $3,000 |

| Minimum activity license (no need to file a business tax account) | Between $3,000 and $100,000 |

| Standard business license (filing of business tax account) | More than $100,000 |

Obtaining a business license may come with a fee of $15.

3. Complying With Local Zoning Regulations

The only known zoning law on dispensaries in Tennessee is to not establish a hemp-derived retail location one thousand feet from a private, public, or charter school. Aside from this, separate zoning regulations need to be followed as a brick-and-mortar establishment.

Find your city’s zoning regulations by reviewing local ordinances or calling your town’s zoning and planning department.

You can run your business outside of your residential house, but residential zoning laws might be stricter.

4. Ensuring Compliance With Regulatory Audits

Prepare for regulatory audits by scheduling regular internal audits. Always support everything with proper documentation. Do this by keeping detailed financial records and accomplishing the audit checklist guidelines for doing business in Tennessee.

| 🆘 Helpful Article Aside from regular audits, you need to be able to handle taxation for selling CBD, Delta 8, and other cannabinoid-based products. Since hemp-derived products are now federally legal, these products are no longer subject to the IRS Code 208E. |

5. Preparing Contracts With Suppliers and Contractors

If your dispensary is not vertically integrated, you would need the help of several suppliers, service providers, and other contractors to establish your business. For this reason, you need to have well-negotiated contracts for each of these players in the industry.

Should an issue arise, a written contract gives your lawyers a better fighting chance in court to defend your brand.

Try not to use contract templates. Hire experts in the field to draft them for you.

6. Reviewing Tennessee’s Employer Responsibilities and Labor Laws

The old but true adage says, “If you take care of your employees, your employees will take care of you.” It’s never been more critical to know the rights and privileges of your employees under the labor laws of Tennessee.

Unless you have a Human Resource manager, here are some facets of labor laws that you should know:

| Labor Law Facets | Branches | Definition |

| Recruitment & Hiring | Pre-Hire Medical, Physical or Drug Testing | Employers have the right to ask applicants to complete job-related medical and physical tests. |

| Drug-Free Workplace Program | Businesses have the liberty to implement a drug-free workplace program to qualify for compensation benefits. Also, employers may require drug testing. Those who fail may be terminated, except for those who have been medically prescribed for the last six months. | |

| Lawful Employment Act and E-Verify | Employers with 35 or more employees need to utilize the Tennessee E-Verify employment verification process. | |

| New Hire Reporting | Employers are required to submit “new hire” reports to Tennessee’s Department of Labor and Workforce Development “within 20 days from the date they are hired.” | |

| Ban the Box Legislation | Employers are prohibited from asking about a candidate’s criminal history during an initial screening application. Employers may do a background check later in the application process. | |

| Salary History Questions & Disclosures | Employers can ask applicants about their salary history. | |

| Wages and Hour | Equal pay | It’s prohibited for employers to base pay on sex. An employer may only create wage differentials based on seniority, merit system, and other reasonable factors other than sex. |

| Paychecks and Wage Payment Timing | Employers may pay employees in cash, by check, or by direct deposit. Also, employers must pay employees no less than once per month. | |

| Deductions from Pay | Without the express permission of the employee, employers can’t deduct from their salary, except for the following conditions: UniformHealth insurance premiums via employee’s requestLoans/Advance | |

| Minimum Wage | $7.25 per hour | |

| Overtime Pay | Fair Labor Standards Act (FLSA) | |

| Meals and Breaks | Employees are provided with a 30-minute unpaid break if scheduled for six consecutive hours. | |

| Breastfeeding Breaks | Employees who need to breastfeed must be given a reasonable unpaid break time to express milk. | |

| Benefits | “Mini-COBRA”/State Health Care Continuation | This responsibility applies to employers with between 2 and 19 employees. This covers up to 3 months’ worth of health care continuation. |

| Fringe Benefits | Employer discretion | |

| Disability Benefits | Refer to the company’s employee handbook | |

| Leave, Absence, and Time Off | Leaves employers should know about | Emergency responder leaveJury duty leaveMilitary leaveMaternity leaveVoting leaveFamily Medical Leave |

| Military Veteran’s Leave | Employers must grant unpaid holiday leave for veterans on November 11 (Veteran’s Day). | |

| Health & Safety | Smoke-Free Workplace | Smoking is not allowed in enclosed public areas, like workplaces. |

| Weapons in the Workplace | Employers can prohibit weapons in establishments. However, individuals can keep their firearms locked away in the safety of their vehicles. | |

| Tennessee Occupational Safety and Health Act | Under the Act, employers must ensure “safe and healthful workplaces by setting and enforcing standards, and by providing training, outreach, education, and assistance.” | |

| Safe Driving Practices | Drivers are prohibited from texting and talking on a handheld phone while driving. Adult drivers may use a hands-free device while driving. | |

| Fair Employment Laws & Practices | The Tennessee Human Rights Act (THRA) | It’s illegal for employers to discriminate based on race, creed, color, religion, sex, age, or national origin. |

| The Tennessee Disability Act (TDA) | Employers must not discriminate based on physical, mental, or visual disability. | |

| The Tennessee Public Protection Act (TPPA) | No employee shall be terminated for refusing to participate or to remain silent about illegal activities. | |

| The Tennessee Pregnant Workers Fairness Act (TPWFA) | The law requires employers to evaluate the accommodation requests of employees experiencing medical needs from childbirth, pregnancy, etc. | |

| Termination | Final pay | Discharged employees should be paid their full salary earned no later than the next payday or 21 days following the date of discharge. |

| Severance | Not required, but not prohibited. | |

| Wrongful Termination | Employers can terminate employees at will without advanced notice. However, employers can’t fire based on discrimination, in retaliation, or not in accordance with the employment contract served at the start of employment. | |

| Mass Layoff Limitations | Worker Adjustment and Retraining Notification Act (WARN Act) Tennessee Plan Closings and Reduction in Operations Act | |

| Required Postings & Notifications | What employers must disclose to their employees | Employers need to disclose the full wage rate. They must not misrepresent the wage rate |

| Required Labor Law Posters | The following posters are required to be posted in an accessible location: TOSHA Safety and Health PosterTN Unemployment Insurance PosterWage Regulation/Child Labor Poster Workers’ Compensation Posting Notice Discrimination in EmploymentVarious Federal PostersMinimum Wage Poster |

7. Securing Partnerships With Banks and Other Payment Systems

Many banks and payment systems in the US aren’t willing to provide their services to cannabis-related businesses like dispensaries. Some outright say no. Limited payment options can slow down sales. It’s important to secure as many partnerships as possible.

Start by knowing which banks service cannabis businesses. Most of them are smaller institutions, community banks, and credit unions. Ask co-dispensary owners. They might let you know what banks and payment systems are they working with.

| 📝 Note Be extra careful with cannabis-friendly banks that are new to the game. Inexperienced banks without the know-how to compliance may shut down the program immediately. Choose established financial institutions that have been working with dispensaries for a while. |

Once you have shortlisted possible banks, follow the steps below in the vetting process:

Step 1: Tell them upfront that you’re operating or are planning to launch a dispensary. Ask them if your business can open an account with them.

Step 2: Read the fine print. Check for capacity restrictions.

Step 3: Consider the cost. Look at the fees for wires, payroll, checks, online banking, etc.

8. Getting Insurance

All businesses including dispensaries should have insurance coverage. The insurance policy addresses the risks of operating a dispensary. Such risks may include workplace injuries, property damage, theft, etc.

Once you have a shortlist of insurance companies who accept the nature of your business, follow this vetting process:

Step 1: Gather information and documents about your dispensary.

Before you start looking for an insurance company, make sure you have your business’s information and documents in order. This will make quoting easier and more accurate.

List the following information:

- Business name and address

- List of products your dispensary sells

- All of your employees’ information

- Financial statements

- Previous claims

Step 2: Bundle your business insurance.

Think about the things in your business that you want to be insured. One of the solid business bundles for dispensaries is with business owners policy (BOP).

The BOP bundle includes general liability insurance, commercial property insurance, and business interruption insurance. It’s cheaper to buy these policies together than separately.

Step 3: Compare insurance quotes.

Compare business insurance quotes from multiple companies. Independent insurance agents offer free quotes online.

9. Aligning Your Business According to the State’s Cannabis Laws

Hemp is legal at the federal level but the industry is still one of the most regulated in the country. For example, the Food and Drug Administration has some reservations about infusing hemp-derived compounds like CBD into certain types of human consumption. Additionally, some municipalities have their cannabis laws and regulations.

Knowing hemp-specific laws at the national and state level is necessary to ensure that your business operates within legal limits.

With that said, here are some of the most important Tennessee cannabis laws you should know as a potential dispensary owner.

| Regulation Category | Details | The Law |

| Products | You can only sell hemp-derived products that contain less than 0.3% THC. | Sections 39-17-402(16) and 43-26-102(4)(B) of the Tennessee Code Annotated |

| The distribution of “marijuana” which is defined as a cannabis-derived product with greater than 0.3% THC content is prohibited. | Section 39-17-417 of the Tennessee Code Annotated | |

| It is illegal to sell drug paraphernalia in Tennessee. Drug paraphernalia is all equipment, products, and materials used for “planting, propagating, cultivating, growing, harvesting, manufacturing, compounding, converting, producing, processing, preparing, testing, analyzing, packaging, repackaging, storing, containing, concealing, injecting, ingesting, inhaling or otherwise introducing into the human body, a controlled substance.” | Section 39-17-425 of the Tennessee Code Annotated | |

| It is prohibited to sell ingestibles formed in the shape of animals or cartoon characters. | Senate Bill No. 378 | |

| Location | Businesses selling products with greater than 0.3% THC concentration can’t use real estate in Tennessee. Also, hemp-derived products can’t be sold within 1,000 feet of any K-12 school. | |

| Packaging and Labeling | For CBD oil products, the state requires that the THC level is printed on the bottle. | Section 39-17-402(16(F)(i) of the Tennessee Code Annotated |

| Advertising and Marketing | Drug paraphernalia is banned from being promoted in any newspaper, magazine, handbill, or other publication in Tennessee. Furthermore, retailers are prohibited from marketing their business and products to ads appealing to those under 21. Examples are ads featuring comic books, video games, television, movie characters, etc. | Section 39-17-425(c)(1) of the Tennessee Code Annotated |

| Age Restriction | You should be at least 21 years old to buy from dispensaries. You would need to present a valid driver’s license or other government-issued ID containing a photograph of the individual. The ID should confirm the person’s age as 21 or above. | SB No. 378 |

| Product Samples | Hemp-derived cannabinoids are not permitted to be sampled in streets, parks, or sidewalks. | SB No. 378 |

| ✅ Pro Tip As you get to know more about the legal side of launching a dispensary, it’s important to be honest about how well you can handle them. You can hire a third-party law firm, agent, or attorney to process them if you’d rather devote your time to planning the other parts of the business. |

Update About the Proposed State Testing Rule

Potential dispensary owners might want to get informed about a new proposed state testing rule before diving into the business. When passed, it could make several big changes in hemp retailing.

Under current laws, dispensaries can sell hemp or cannabis-derived products that contain less than 0.3% Delta 9 THC. However, with the proposed testing rule by the state’s Department of Agriculture, THCA may soon be included in the 0.3% limitation.

Several coalitions are considering the rule as “unrealistic” as most hemp flowers contain more than 0.3% THCA content. Tennessee Growers Coalition Executive Director Kelley Hess says “…all of that popular CBD, CBD flower, THCA flower will be non-compliant and will be banned and will become illegal.”

The proposed rule is not yet official. Public comment is expected to commence on February 6, 2024, at the Tennessee Department of Agriculture’s Porter Building Atrium.

Start Selling Wholesale With the Hemp Doctor

If you’re in the process of selecting hemp products to sell quickly from shelves, come and sit with us. We at the Hemp Doctor Wholesale would love to extend our success story to your business.

Frequently Asked Questions

How much does it cost to open a dispensary in Tennessee?

There is no specific cost to open a dispensary in Tennessee but the general proposed cost of opening one ranges from $150,000 to $2 million.

Are dispensaries legal in Tennessee?

Yes, dispensaries are legal in Tennessee as long as they’re only selling hemp-derived products with less than 0.3% THC content.

Can you grow THCA in Tennessee?

Yes, you can currently grow THCA-rich flowers in Tennessee with less than 0.3% Delta 9 THC. You would need a license to cultivate from the state’s Department of Agriculture.

Where do you find the Tennessee Hemp Processors list?

Find them in the Hemp Alliance of Tennessee’s list of processors.

| Disclaimer: We are not a legal platform. Seek counsel with an attorney or law firm for unique and specific legal concerns. |