Cannabis North Carolina Market Highlights

- In a study, 46.8% of participants living in the Southeastern United States were revealed to be using cannabis for both medical and recreational reasons.

- 30.5% of young adults have the propensity to use cannabis-based products.

- Smoking accounts for most of the ways North Carolinians use cannabis.

- Delta 9 alternatives like THCA are the current leading legal products that get you high, sold in North Carolina stores.

- Most cannabis businesses in North Carolina skip third-party lab testing.

Change is the only constant thing when it comes to any kind of market, particularly cannabis. Consumer habits, cannabis trends in general, local regulations, and business practices evolve periodically. Hence, there are several insights to unpack with some too important to disregard.

To help you map out the latest climate on the industry of cannabis in North Carolina, here are some of the relevant observations, statistics, and data today.

Dive in to find out.

2024: The Current North Carolina Cannabis Market

Once hailed as one of the first southern states likely to legalize marijuana, North Carolina has yet to legalize recreational or even medical marijuana. 2023 adjourned with no bills passed about marijuana legalization.

For a state with zero bills touching on marijuana last year, it’s curious that a thriving cannabis derivatives market exists. What’s the secret? Hemp businesses can legally operate within the state under the 2018 Farm Bill.

The bill now passed as law legalizes hemp and its derivatives at the federal level as long as the product has less than 0.3% Delta 9 THC content.

Across North Carolina, there are over 70 registered retail cannabis businesses in Google Maps. If North Carolina’s 10,835,491 population all purchases a hemp-derived product, your business can have a chance of snagging 154,792 customers a month.

With that said, let’s zoom into your possible North Carolina customers—discover what makes your target market tick along with actionable insights to adopt.

| 📑You might want to read… Four states and one US territory finally legalized adult-use marijuana in 2023. Discover positive strides in cannabis legalization in this wrap-up of 2023. |

North Carolina Cannabis Market Statistics Overview

Consumer Demographics

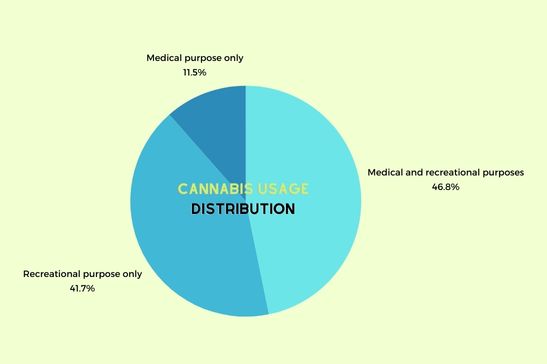

46.8% of participants in a study reported using hemp derivatives for both medical and recreational purposes. (PubMed)

A survey of cannabis users from the Southeastern US which includes states like North Carolina noted that 46.8% of consumers use hemp derivatives for both medical and recreational intentions.

Additionally, 41.7% reported using hemp products for recreational reasons while only 11.5% consumed them for medical purposes.

67.9% of users’ reason for taking medical cannabis is for mental well-being. (PubMed)

Among the 252 out of 432 participants, over 60 unique conditions were listed as their reason for taking cannabis. The most commonly reported reason for use is for mental well-being.

14.32% of adults in North Carolina used cannabis in 2021. (Statista, NORML)

Despite the rarity of dispensaries and retail outlets within the state, 14.32% of the population, or roughly 1,510,760, have tried cannabis in 2021. That number is projected to increase rapidly once the state legalizes weed in North Carolina.

According to a state-wide poll, 54% of voters from North Carolina support the legalization of adult-use marijuana.

Young adults aged 18-25 have an average prevalence of 30.5% for cannabis use. (SAMHSA)

The prevalence of cannabis use among young adults is growing each year. Between 2002 and 2004, a prevalence of 25.7% was noted. From 2017 to 2019, the commonness grew to 30.5%.

Now that marijuana possession has been partially decriminalized for half an ounce or less, cannabis use among young adults is projected to grow.

The average age range in North Carolina is 25 to 34 years old. (Statista, Headset)

In 2022, 13.3% (the highest) of the population in North Carolina was between the ages of 25 to 35. Second to that at 12.9% were ages between 35 to 44 years old.

Millennials make up the majority of cannabis sales. In 2020, 42% of medical cannabis sales and 48% of recreational cannabis sales were from the millennial generation.

Product Sales and Trends

Smoking is the primary method of cannabis consumption. (PubMed, Table 2)

In the same study, participants’ primary method of consuming hemp was by smoking. 5.6% said they use vaporizers, while 2.8% have been dabbing concentrates.

Those smoking cannabis colored with medical intention seem to be more conscious of the percentage of THC per product. They are also the ones with a proclivity to buy products with higher potency.

THC isomers Delta-8, THCA, and many others lead the hemp-derived psychoactive products offered in North Carolina stores. (Alpharoot)

As a state without marijuana recreational and medical programs, North Carolina business owners rely on low-THC hemp derivatives like THCA to offer “legal highs” without getting penalized.

THC isomers, also known as analogs, are semi-synthetic compounds structurally related to Delta-9-tetrahydrocannabinol. Isomers also offer the sought-after high found in the main psychoactive cannabinoid. The only difference is they’re legal.

Poll reveals that 8 in 10 North Carolina residents support medical cannabis legalization. (Meredith Poll)

Among the 760 surveyed individuals in January 2024, 78% of the respondents support the legalization efforts of medical cannabis while a mere 18% oppose it.

North Carolina isn’t completely devoid of a medical cannabis program. The Indian tribe “The Eastern Band of Cherokee” began issuing the first batch of medical marijuana patient cards in October 2023 amidst several statewide legalization stalls.

The average CBD product price range in North Carolina is $15-30 per 300 mg. (NCBI)

A 2022 study found that despite low CBD concentrations, CBD products sold by the majority of stores are quite expensive at $15-30 for every 300 mg of CBD extract. The price per mg increases as the CBD content scales.

Wholesalers know the importance of investing in products worth their price. Checking a product’s COA details is key in determining the cannabinoids included in the mixture and their concentration level.

Market Challenges and Opportunities

Most of the hemp cultivated in North Carolina is now utilized for fiber. (Hemp Today)

According to Hemp Today, 1,550 acres of hemp farming were for the production of hemp fiber, dwarfing 77 acres of hemp dedicated to producing CBD in the state.

North Carolina could make $44.4 million in 2028 if the NC Compassionate Care Act is passed. (WCNC)

Senate Bill 3 or the North Carolina Compassionate Care Act aims to create a regulated medical cannabis program in North Carolina that caters to seriously ill patients with a physician’s recommendation.

Along with that, the bill also uncovered an economic impact that would contribute up to $44.4 million in gross revenue once medical marijuana is legalized. As soon as 2024, the state could make $15.1 million as soon as the bill is passed this fiscal year.

Most cannabis businesses in North Carolina choose to skip third-party lab testing for products. (ABC News)

With the North Carolina Industrial Hemp Pilot Program ending in 2022, fewer companies feel compelled to willingly undergo the expensive third-party lab testing process for their products.

Instead of going with the flow, smart cannabis businesses take this opportunity to stand out and project their credibility by submitting their products for rigorous testing.

If you’re a reseller of cannabis products from different brands, the rampant lack of quality testing should make you extra picky when it comes to brands you would want to invest in.

The majority of CBD online stores in North Carolina do not comply with the FDA regulations on banning medical or health-related claims. (NCBI)

A study that analyzed North Carolina-based online CBD stores determined that most stores are displaying medical or health-related claims that put them at risk of violating FDA marketing regulations.

It’s important to execute an audit of your product packaging and online pages for terms and insinuations that might get you in trouble with the FDA.

North Carolina has to grow 40,000 pounds to meet the needs of medical patients and another 80,000 pounds for recreational demand. (Cannabis Business Plan)

According to a research group hired by Qualla Enterprises, they found that a combined volume of 120,000 pounds of cannabis is needed to meet the demand across medical and recreational users within North Carolina.

Geographical Business Opportunities

Discover nuggets of business opportunities from this profiling of key North Carolina cities like Raleigh, Charlotte, and Mooresville. Expect data relevant to cannabis businesses in terms of demographics, economy, consumer behavior, and more.

Raleigh (Capital City)

The city of Raleigh is a bustling melting pot of institutions, research, and business. It’s part of the top 10 cities with the most rapid success in economic development within the US.

Ranked as the #1 city with the best quality of life, Raleigh has one of the most solid employment and wage growth. The population number is expected to rise as well.

Raleigh offers endless opportunities for small and mid-sized businesses. Programs like Impact Partner Grants and Sustainable Business Toolkit give business owners tools to empower them.

Despite zero cannabis programs, Raleigh’s budding hemp derivatives business continues to grow into lounges, retail stores, and more.

Here’s a profile of the city:

| Demographics | Population size | 469,124 |

| Age distribution | Below 18: 20.9% 18-24: 15.9% 25-44: 36.6% 45-64: 18.4% 65 and older: 8.3% | |

| Household income levels | $46,612 per annum | |

| Education | Third-most educated city in the US. | |

| Geography | Business landmarks | Inside the Beltline Midtown Raleigh East Raleigh West Raleigh North Raleigh South Raleigh Southeast Raleigh |

| Population per square mile | 3,178.9 | |

| Five of the most populated areas | Boylan Heights University Park Cameron Park Midtown Wakefield | |

| Economy | Major industries | Finance Electrical Medical Telecommunication Clothing Food processing Paper Pharmaceuticals |

| Poverty rate | 11.81% | |

| Unemployment rate | 4.3% | |

| Sales tax rate annually | 7.3% | |

| Average income per individual | $31,169 a year | |

| Culture and recreation | Parks and recreational areas | Community centers Pullen park Arboretums |

| Events and festivals | Home of the Raleigh Kubb Vintage Bazaars Triangle Restaurant Week Annual African American Cultural Celebration Krispy Kreme Challenge Art in Bloom Tacos ‘N Taps Dreamville Festival | |

| Dining and entertainment options | Live music restaurants Clubs and pubs North Carolina-Style Barbecue shops and restos Cafes DinersKitchen + Bar | |

| Cannabis Culture | Hemp Lounges Retail stores E-commerce store | |

| General Consumer Preferences and Behavior | Online/Digital habits | 97.5% of households have computers |

| 93.2% of households have broadband internet subscriptions | ||

| Purchase drivers | Price Lifestyle preference Convenience Trends | |

| Shopping habits | Prudent spending | |

| Concerns with inflation | ||

| Rise in downtown shopping with a 56% increase in sales | ||

| Health and wellness trends | Rising demand for virtual health | |

| Expansion of behavioral health companies | ||

| Social media habits | Peak social media times: 8-9 AM and 5-6 PM | |

| Dominating platforms: Instagram and TikTok | ||

| Social media with e-commerce features |

Charlotte (Most Populous City)

The most populous city in North Carolina garnered the attention of the international business community post-pandemic. Its swift economic recovery speaks of the city’s efforts to pull up businesses of all sizes.

Among Charlotte’s many charms is its close geographical connections to America’s biggest hubs such as it being a gateway to the southeastern part of the country.

Take a look at the numbers defining Charlotte:

| Demographics | Population size | 879,709 |

| Age distribution | Male: 51.0 Female: 49.0 | |

| Median age: 34.5 | ||

| Average household income | $68,367 | |

| Education | High School: 2.13M graduates College: 1.85M graduates Bachelor’s Degree: 1.58M holders | |

| Geography | Business landmarks | Southpark Uptown Southend Ballantyne University City |

| Population per square mile | 2,836.9 | |

| Most populous areas | University City East Charlotte | |

| Economy | Major industries | Finance & Insurance Health Care & Social Assistance Retail Trade |

| Poverty rate | 11.6% | |

| Unemployment rate | 3.30% | |

| Sales tax rate annually | 7.25% | |

| Average income per individual | Male: $69,811.7 Female: $52,490 | |

| Culture and recreation | Parks and recreational areas | *Same with natural landmarks |

| Events and festivals | Black Food Truck Festival Brewsology Mardi Gras Gumbo Cook-off BBQ Festivals Greek picnics | |

| Dining and entertainment options | Craft beer Bars and pubs Vineyards Carowinds Art museums Amusement parks | |

| Cannabis Culture | Retail stores | |

| General Consumer Preferences and Behavior | Online/Digital habits | 96.1% of households have computers |

| 91.9% of households have broadband internet subscriptions | ||

| Purchase drivers | Lifestyle Personal development Wellness Social responsibility Convenience | |

| Shopping habits | Prefers to shop in-store | |

| People buy more in the last quarter of the year | ||

| Health and wellness trends | 87.2% of the population has health coverage | |

| Social media habits | Major platforms: Facebook, Instagram, LinkedIn, Twitter, and Snapchat | |

| Influencer marketing | ||

| Interactive Ads | ||

| Mobile Optimization |

Mooresville

Choosing Mooresville as your cannabinoid business hub might be just the smartest move you can make (that’s why The Hemp Doctor is here!). The population is a diverse group of skilled and young people with the highest median household income of $75,141 compared to Raleigh and Charlotte.

We would love for you to come and have a chat with us at our store located in Port Village Shopping Center.

In the meantime, check out the interesting stats that made us adore doing business with the city:

| Demographics | Population size | 48,431 |

| Median age | 35.9 | |

| Household income levels | $75,141 | |

| Highest Level of Education | High School College | |

| Geography | Business landmarks | Town Square Morrison Plantation Gateway Village Lake Norman Regional Medical Center Area Highway 150 Corridor |

| Population per square mile | 2,019 | |

| Most populous zip codes | 28117 28115 | |

| Economy | Major industries | Retail Trade Manufacturing Health Care & Social Assistance |

| Poverty rate | 8.19% | |

| Unemployment rate | 3.50% | |

| Sales tax rate per annum | 6.75% | |

| Average income per individual | Male: $39,524 Female: $24,939 | |

| Culture and recreation | Parks and recreational areas | Art museums Lake activities Day spas Golf centers Libraries |

| Events and festivals | St. Patrick’s Day Veterans Spouses Day Out Shamrock festivals | |

| Dining and entertainment options | Waterfront restaurant Fine dining Amstar cinemas | |

| Cannabis Culture | Medical cannabis discussions Retail stores Private cannabis-themed parties | |

| General Consumer Preferences and Behavior | Online/Digital habits | 97.5% of households have computers |

| 96.6% of households have a broadband internet subscription | ||

| Purchase drivers | Emotional appeal Social influence Brand loyalty | |

| Shopping habits | Increase in e-commerce shopping | |

| Favors convenience and accessibility | ||

| Automotive industry influence | ||

| Health and wellness trends | Mental health awareness Fitness communities Alternative therapies Outdoor activities Healthy diet | |

| Social media habits | Popular platforms include Facebook, Instagram, Twitter, Snapchat, and LinkedIn. | |

| Some of the primary motivators for engaging in social media are community connection, retail interaction, and influencer culture. |

Leveraging Your Cannabis Business Tailored for North Carolinians

Based on the trends gathered and the strong possibility of cannabis legalization in North Carolina, cannabis businesses stand a good chance of growing their market this year. By strategically positioning your cannabis venture according to the current wave, you’ll be at the right spot once the herb fever takes full effect.

As the state’s cannabis industry is gaining momentum, it’s never been more important to partner with an established wholesale cannabis company. The Hemp Doctor Wholesale’s extensive selection of legal Delta 8, THCA, CBD, CBN, and CBG products is a refreshing take on the usually limited selection of wholesale items.

Now that you’ve seen the facts, it’s time to take action. Don’t miss out on this chance to widen your reach!

Source